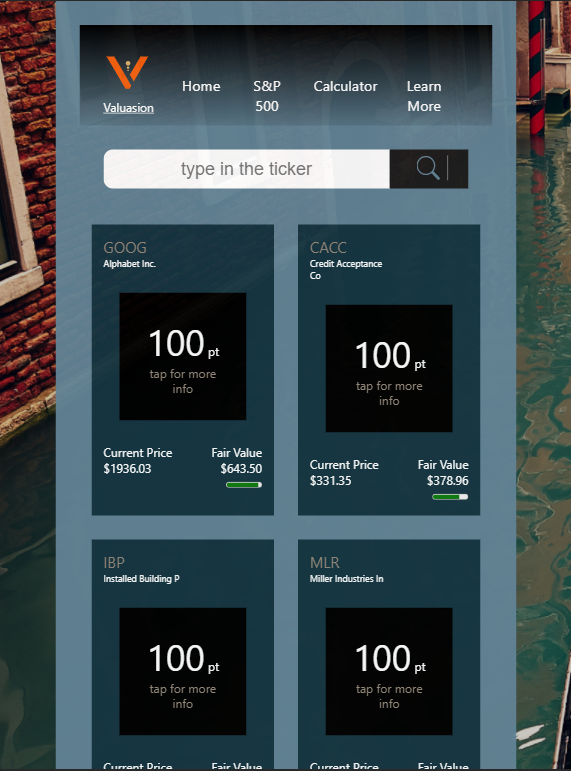

Valuasion is an investment tool based on the concept of value investing. One challenge when it comes to finding good companies to invest in is knowing if a company has long term growth. Valuasion takes away all the guess work by analyzing company financial data and rating the company on a scale of 1 to 100. There are 5 key metrics Valuasion uses to determine if a company has strong potential growth:

- Return on Invested Capital

- Book Value Per Share

- Free Cash Flow

- Earnings Per Share

- Revenue

The list is ordered based on the importance of each metric with ROIC being the most important. We are looking for a growth rate of 10% or higher on each of the key metrics. When all the key metrics have a growth rate greater or equal to 10%, the company is considered strong and profitable.

The main idea behind value investing is to find great companies that are discounted so that we can buy them for cheap. We are looking for companies that have a stock price at around 50% of their fair value assessment. The fair value of a company is calculated based on the 5 key metrics listed above. When we purchase stocks at a 50% discount, we can feel confident that we're not overpaying and comfortable that the company will eventually return to fair market value.

The fair value of a company assumes an annual growth rate of 15% and our invested capital doubling in 5 years. The idea is that the company will have figured out and fixed the problem that caused the company's share price to trade at a discount.

No comments